Let the predictions begin…

Windermere’s Chief Economist Matthew Gardner dusts off his crystal ball and peers into the future to give us his predictions for the 2021 economy and housing market.

U.S. ECONOMY

Gardner predicts a rise in housing inventory, as people who can work remotely move farther away from their offices, or those whose homes aren’t conducive to remote work seek out a better living arrangement.

But Gardner also pragmatically points out that a “mass exodus” completely away from urban centers is unlikely, as many workers may find themselves with a flexible blended arrangement of remote work and a few days in the office per week.

HOME SALES

Gardner is predicting a large increase in home sales in 2021 (he covers new construction separately). His forecast puts home sales up by 6.9%, a level that hasn’t been seen since 2006.

NEW CONSTRUCTION

With the rising demand for housing inventory, Gardner predicts that new construction starts for single-family homes will rise by a sizeable 16.4%. This is great news for builders, and also for buyers, as increased inventory may help to alleviate the incredible demand the market has been experiencing.

MORTGAGE RATES

Along with increased starts, Gardner is anticipating an increase of 18.7% in new home sales for 2021—again reaching a level the market hasn’t seen since 2006.

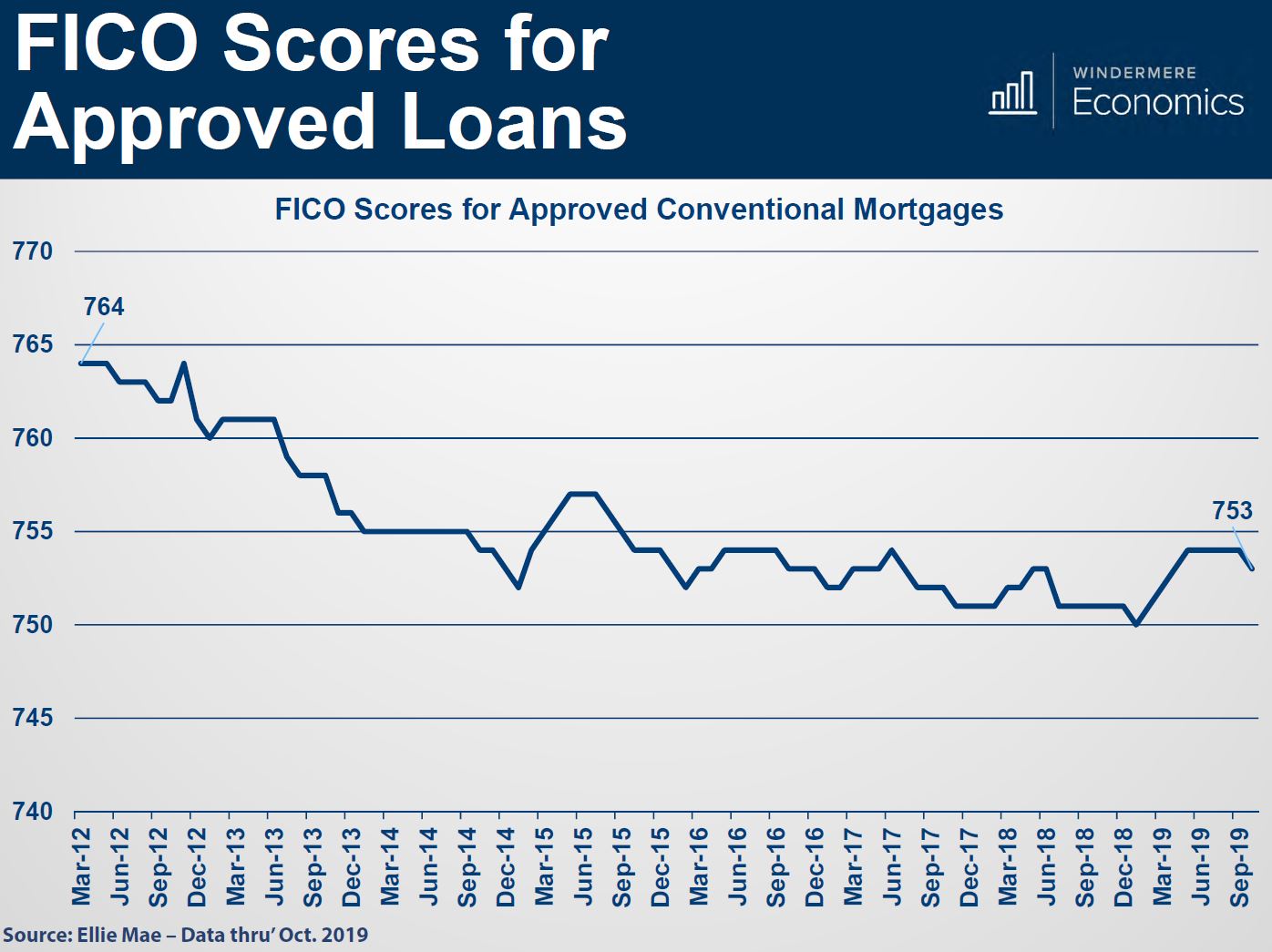

Throughout 2020, mortgage rates hit historic lows, largely due to the impact COVID-19 had on the housing market. These low rates drove already high demand for housing even higher, and Gardner does not predict mortgage rates will rise significantly in 2021.

His current forecast sees mortgage rates dropping to their lowest rate in the current quarter at 2.83%, and rising to about 3.08% by the fourth quarter of 2021.

CONCLUSIONS

Though Covid has certainly impacted the housing market in ways we never could have anticipated, there is plenty of reason to believe the market will continue to recover in 2021. New home construction and sales provide a particularly optimistic outlook, while low mortgage rates could give first-time buyers a chance to break into the market.

Click the link below for Matthew’s weekly economic and housing update on the Windermere blog.

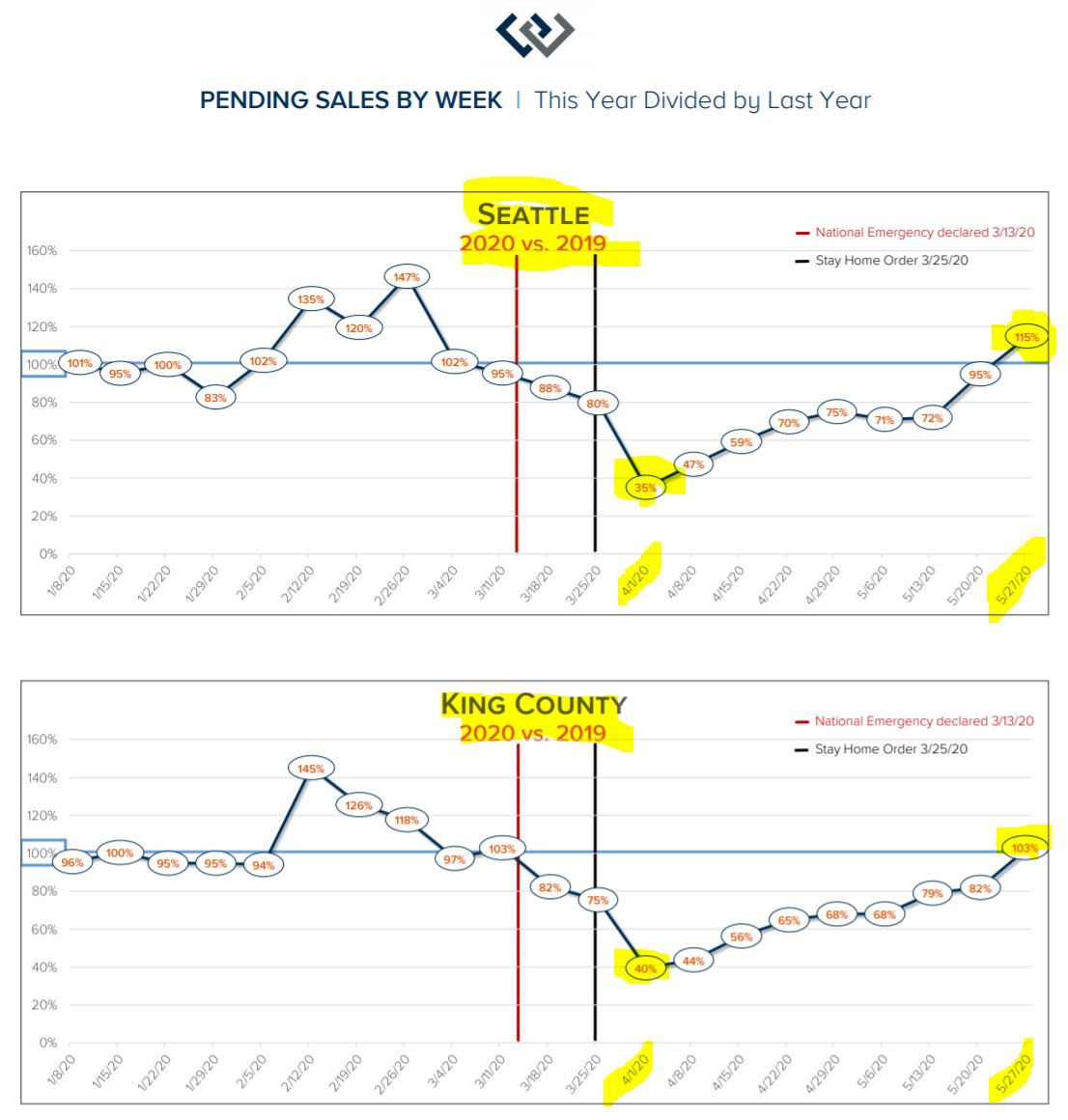

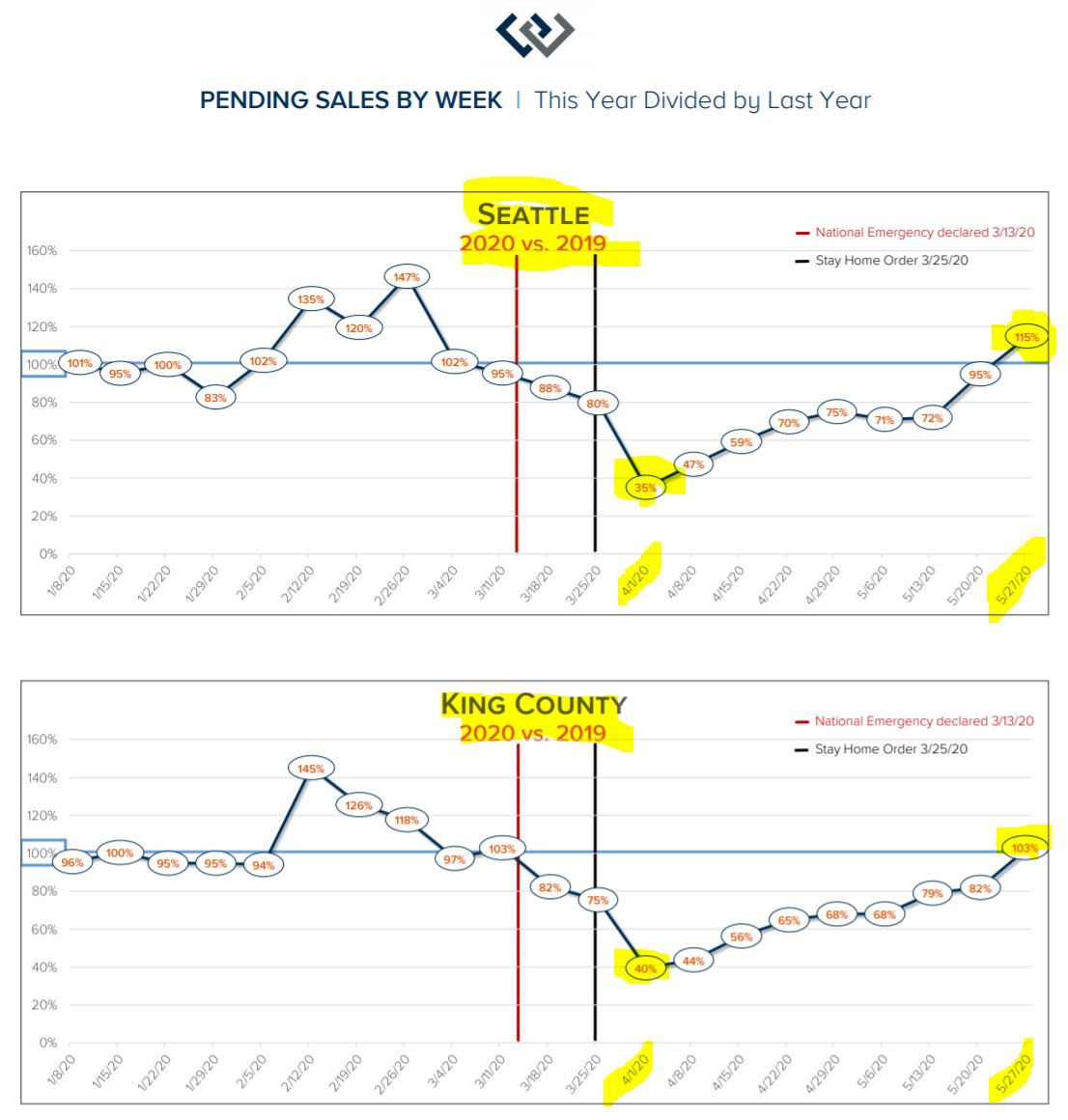

Pending Sales up +15% vs LY!

I’m still amazed at the residential housing market’s resiliency through all that his happening in our economy.

Cliff notes below from our designated broker, Laura Smith –

Expect more new listings. Expect more new pending sales. Historically March to July are the five months with the most new listings (10 year average for King County Residential shown in table below). The coronavirus likely delayed new listings by 45 to 60 days. What will happen with more new listings? More new sales. My guess is starting in July number of sales in 2020 will exceed the number of sales in 2019.

King County Residential Only for the weeks ended Wednesday (5/27/20):

Summary (details below):

The number of new pending sales in the last seven days exceeded the same week in prior year.

- Expect next week for sales to be between 80% and 100% of the prior year.

- Memorial Day under the stay order had less impact on sales than Memorial Day with no stay order.

Number of King county pending sales increased for the last nine weeks:266, 309, 367, 460, 489, 508, 598, 622, and 645.

We need inventory! Inventory is down over 40% and sales are equal to a year ago.

Months Supply of Inventory is low enough to make multiple offers commonplace:

- King County is 0.9 > down 40% from a year ago (1.6).

- Seattle is 0.9 > down 53% from a year ago (1.9).

- Eastside is 1.0 > down 50% from a year ago (2.0).

Questions to Ask During Your Virtual Home Tour

This is a great article from our Windermere Blog by Sandy Dodge in our new reality of real estate.

Questions to Ask During Your Virtual Home Tour

Posted in Buying by Sandy Dodge

Image Source: Canva

Thanks to COVID-19, the new reality is that many open houses and home tours are being conducted virtually. For prospective home buyers, this new territory brings an added element to prepare for in the home buying process. Some of the questions that should be asked in a virtual home tour parallel those of in-person tours, but others are unique to today’s virtual world.

Could you zoom in?

- Sometimes it can be difficult to get a true glimpse at what you want to see in a room. Asking the agent to zoom in on specific features is commonplace in virtual home tours, and they understand this is part of the viewer experience. Don’t hesitate to ask multiple times. Getting a better look at everything you want to see will help you feel like you’ve gotten the most out of your virtual tour.

How many square feet are in this room?

- Virtual tours can slightly distort space, making it tough to gauge the size. The room-to-room square footage is information the agent is sure to have handy. Since you can’t be there in person, it will help you piece together the virtual visuals with the sense of physical space that we’re all accustomed to feeling in the places we live.

What color is that?

- In the smartphone era, and computer era at large, we have come to understand that digital representations of color are not always true to the eye. Ask the agent to confirm specific colors so you can plan accordingly. Have a color swatch on hand or look the colors up online as you go through the tour.

When were the appliances last updated?

- The importance of this question rings true in past, present, and future. Knowing the state of the home’s appliances, and the likelihood and timing of when they will need replacement, is vital information for both assessing the move-in readiness of the home and understanding what costs might lie ahead.

Has the seller provided an inspection?

- This is another example of a critical question, whether your home tour is virtual or physical. If the seller has already done an inspection, ask the agent to lead you to any areas of concern based on the inspector’s findings. If there is anything that has not yet been addressed by the seller, have your agent ask what their plan is for making the necessary repairs/updates.

When is the offer review date?

- Understanding the seller’s timeline for reviewing and accepting offers will help guide your decision-making process and allow you to strategize based on the timeline.

Whether your home tour is physical or virtual, getting the information you need to make an informed decision remains paramount. Although there is no substitute for physically being in the home you are looking to buy, keeping these questions in mind will position you well as you progress through the home buying journey.

Breaking News – More Counties to Phase 2

WR & NWMLS RELEASE REAL ESTATE GUIDANCE FOR PHASE 2

May 20, 2020

Governor Inslee announced that ten additional Washington Counties have been approved to apply for Phase 2 recovery status. Additional counties will be considered by the administration to apply when their infection rates per thousand residents meet the threshold set by the Governors recovery plan. Counties must also demonstrate the health care capacity and tracing ability to qualify.

The counties now approved for Phase 2 must comply with the regulations and protocols set forth by the Governor to protect public safety.

Washington REALTORS® and the NWMLS have revised the Covid-19 Frequently Asked Questions to assist you in applying those regulations to your day-to-day business. Please discard previous copies of your FAQs for this revision.

Leadership and your Government Affairs team have worked very hard to earn these modifications, please continue to demonstrate compliance with the regulations so we can expand Phase 2 eligible counties.

Phase 1 counties (gray) status has not changed and business practices have not changed from previous weeks. When infections rates go down and other requirements are met, they too can apply for Phase 2.

Recap of modifications for Phase 2 include:

- Real estate firms may open their offices in a limited fashion;

- Commercial brokers can engage in the same in-person services as residential brokers;

- Three persons (as opposed to two persons) are allowed on site for permitted in-person real estate activities for both residential and commercial brokerage (for both improved and unimproved property); and

- Sign installers may install real estate signs.

For both Phase 1 and Phase 2 in-person real estate activities, real estate brokers and industry partners (e.g. appraisers, inspectors, photographers, stagers, etc.) must wear cloth face coverings and should encourage clients and customers to do the same.

Public and broker open houses and similar invitations to view a property without an appointment are not permitted in Phase 1 or Phase 2. Only previews and showings by appointment are allowed.

Brokers must adhere to the “phase” protocols for the county where the property is located, regardless of the location of the broker’s office or home. Brokers conducting real estate activities in a Phase 1 county, must continue to abide by the Phase 1 protocols, which include only allowing two persons in a property, including the broker, at one time.

2020 – Why you want to be in Seattle

I was able to listen to our chief economist for Windermere yesterday for his annual economic forecasts heading into 2020. The slides below illustrate his forecast for the Seattle area moving into 2020. #realestateislocal

Matthew Gardner, while being one of the brightest minds in our company, knows how to deliver a message.

We all know that most economist are calling for a national recession in the not too distant future. But most are now pushing back for this to begin in mid 2021, be short lived and not focused on the housing market like the great recession.

Matthew feels the next recession will be due to the ongoing trade wars with China and the EU as well as our escalating national debt. With interest rates already at historic lows, the Fed will NOT be able to help end the recession by lowering rates.

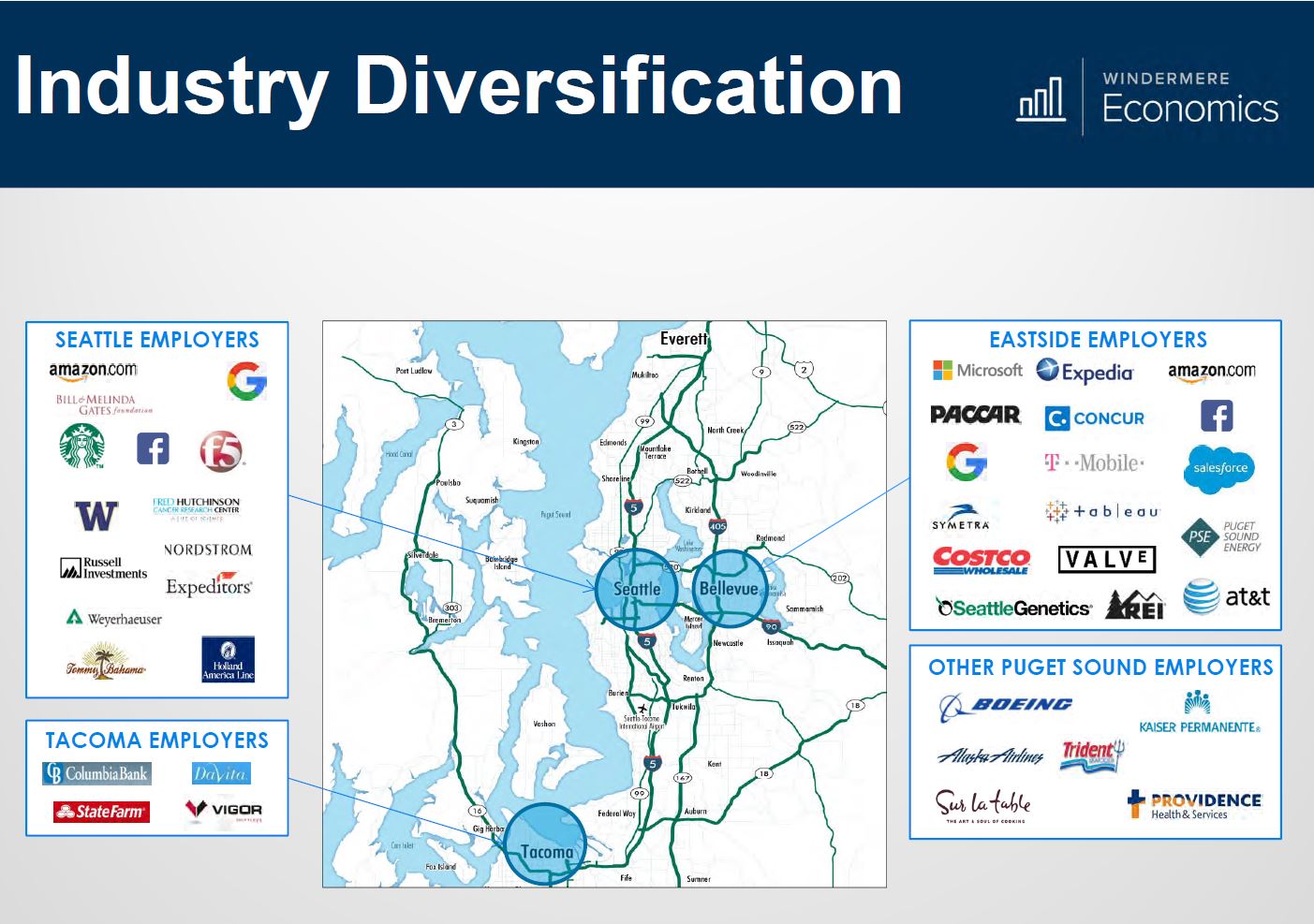

But the Seattle area will be somewhat insulated to these national issues in the coming years, here’s why…

- We’re no longer a one trick pony. Like when this sign from 1973 went up during a Boeing slump. Seattle’s industries have diversified. There are now 34 Fortune 500 companies in the Seattle Area compared to 7 just a few years ago! Boeing is still king with over 80,000 employees in the area but their ups and downs don’t threaten the Seattle economy like they did not too long ago.

- The tech industry is the largest employer in the Seattle Metro area and have driven our unemployment #’s down to 3%.

- The other employers to round out the top 5 for the Seattle area are JBLM, Joint Base Lewis McCord (56,000), Microsoft (42,000), Amazon (25,000) and UW, University of WA (25,000). A healthy mix of different industries that are projected to grow their employment by 2.2% next year, again leading the nation.

- All of these growing companies in the Seattle area are why our economy will continue to expand through 2020.

- There is still no signs of a Housing Bubble.

Gardner Report 2019 – Q3

Our esteemed economist, Matthew Gardner, has released his 3rd quarter assessment of our Western WA real estate market. Enjoy!

WW Stats – Up +10.5% – Median Price!

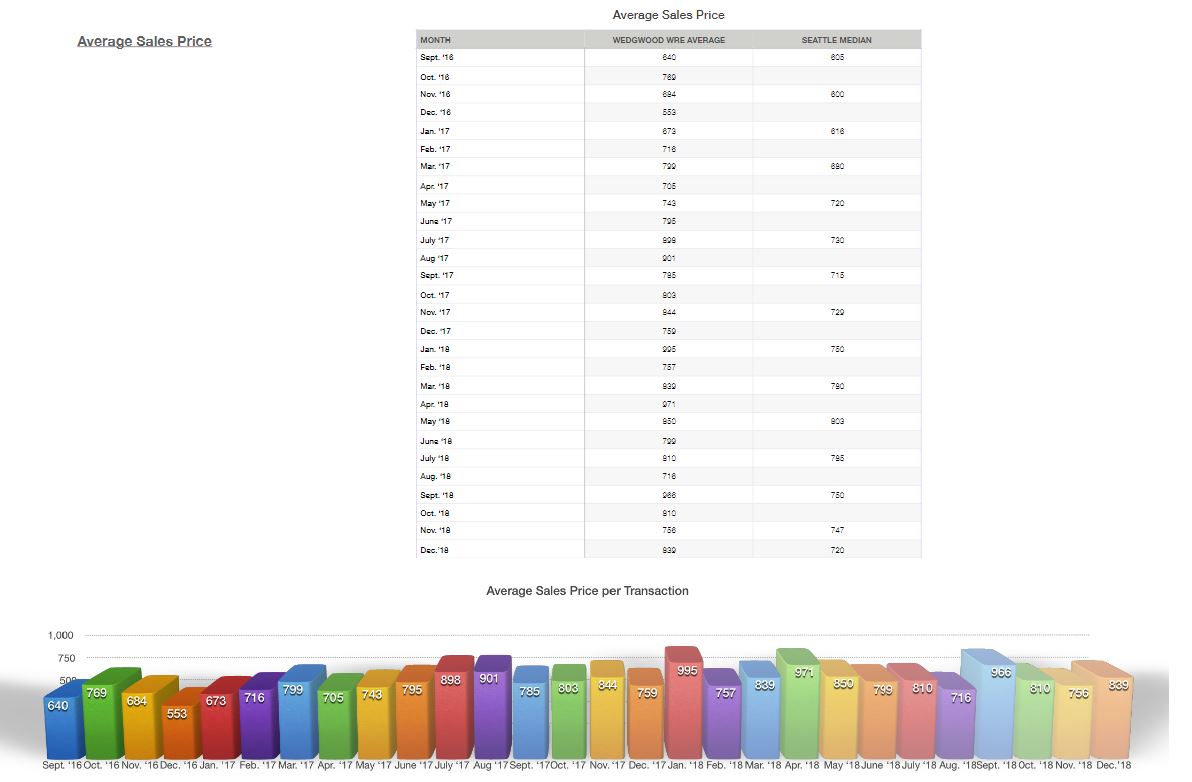

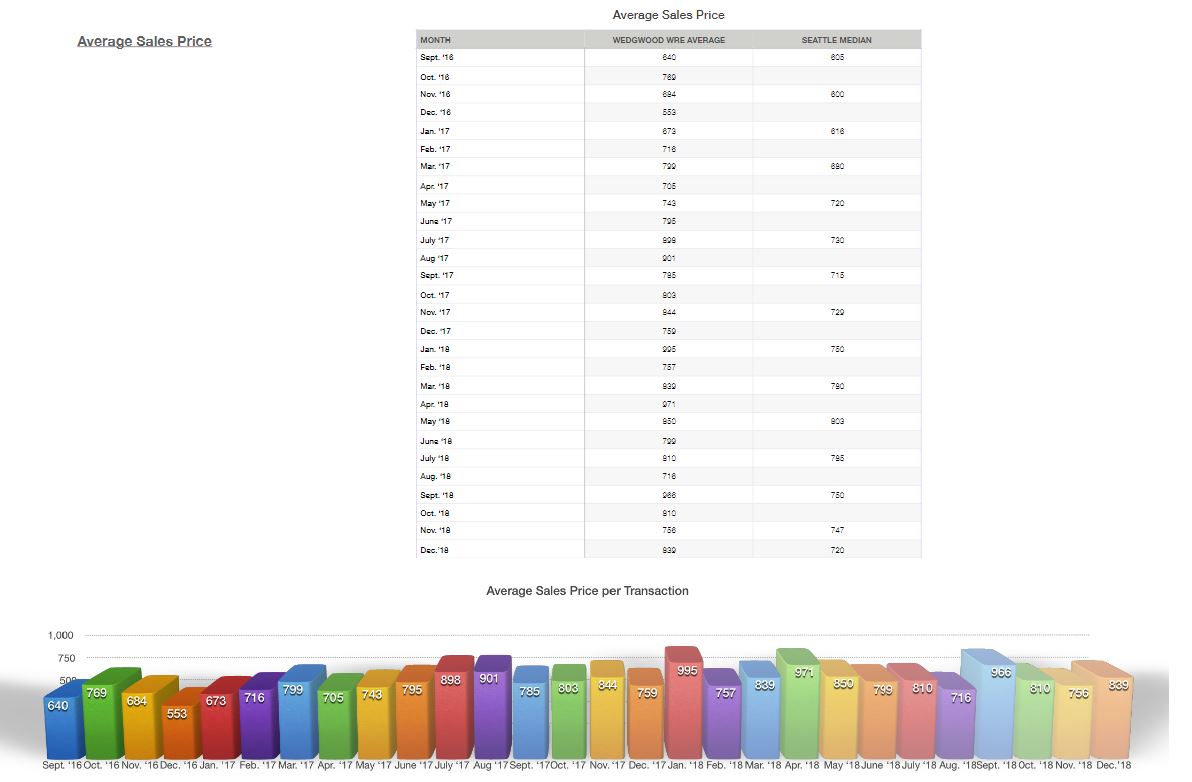

My office, Windermere Wedgwood, publishes statistics for the transactions that we represent each month.

These statistics dive deeper than the basic info you get from online sources.

The pack below shows transaction details like type of financing, cash offers, # of offers and the one I find most interesting this month, median sold price.

The median sold price for the 16 transactions completed by my office in December 2018 was $839k vs. $759k from Dec. 2017 or +10.5%

Even with the Seattle Times headlines about Seattle’s rapid decrease in prices, the numbers don’t lie, +10% vs last year!

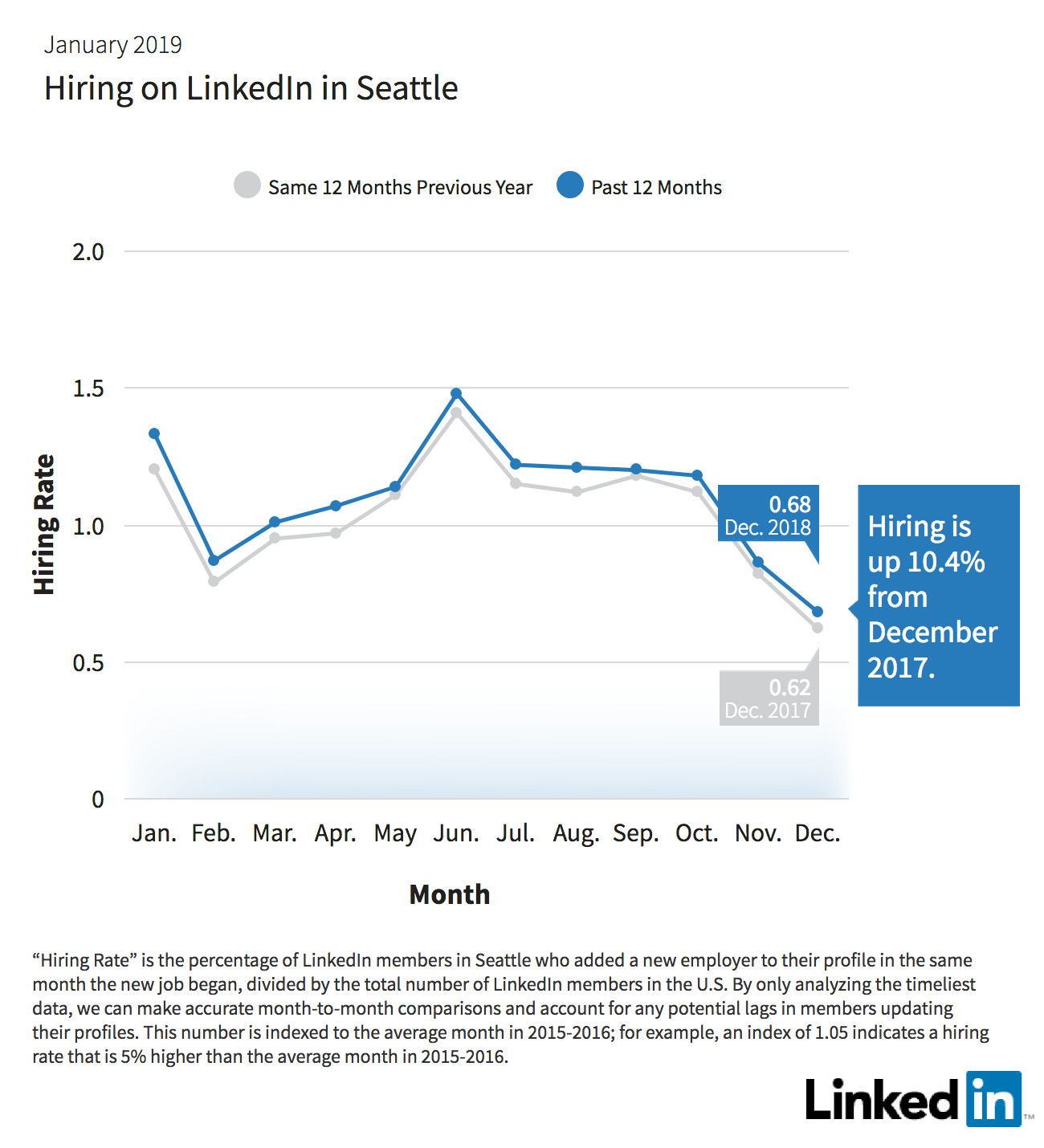

Hiring in Seattle up +10% vs 2017!

So much for the HQ2/3 impact on the Seattle employment picture.

This workforce report is pulled from LinkedIn data but a good indicator of what’s happening in the broader market.

While Amazon might be slowing down their rate of hiring in Seattle, others are ramping up for 2019 and beyond – Expedia, Facebook and Google to name a few.

Seattle is still a great place to invest your real estate dollar and looks to continue…

Increased Loan Limits mean Increased Buying Power

Has your lender told you about the upcoming changes for conforming loans in 2019?

Make sure you’re working with a knowledgeable lender that keeps you informed on the latest and the greatest.

Thank you Matt for always keeping me up to date.

New conforming loan limits for King/Pierce/Snohomish county – all the way up to $726,525.

Gives you more purchasing power and reach.

A $725,000 home purchase will now qualify for a conforming loan with as little as 5% down payment of $36,250.

You’ll be able to afford more home and still be competitive in the changing Seattle area market!

It’s Seasonal, really, plus a few other things…

It’s seasonal, really, we’re going through a slow down in the Seattle market but it’s also seasonal.

What you want to pay attention to in the attached eye chart of a graph is the bottom graph and how every winter (December) for the last 10 years, we see a dramatic slow down in sales.

So yes, the rate of appreciation has slowed in the Seattle area since May 2018.

But, we also see a slow down in transactional sales every winter.

Put them together and it seems more dramatic and remember we had quite a run up of prices over the last 5 years.

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link