We met with our Windermere Economist, Jeff Tucker, at an all co. meeting in Seattle.

See our notes below about the 2026 tailwinds for the housing market + Adam’s weekly mortgage update!

Robert & Lari Johnson | J&J at Windermere

* Macro to Micro Economic Outlook – 2026 – Tailwinds

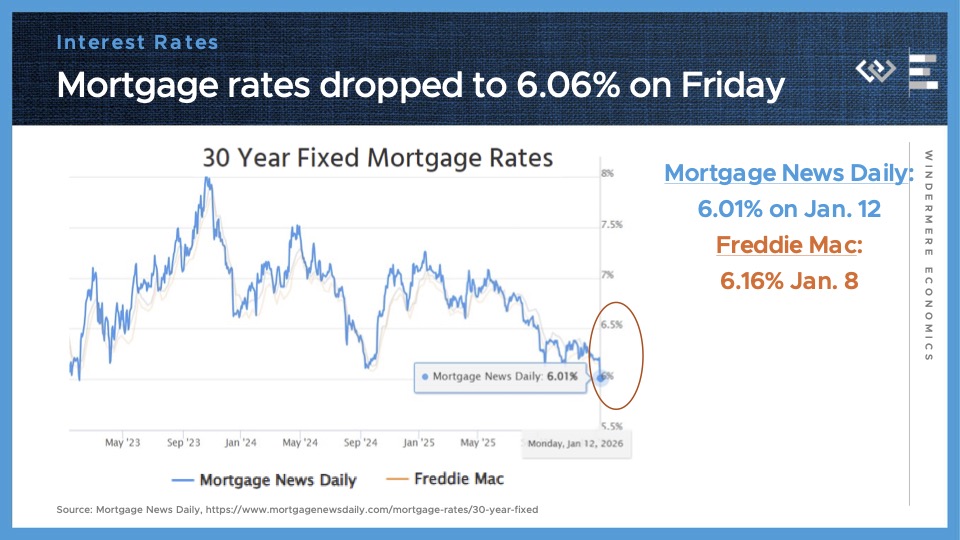

* Government bond buyback lowering rates into the 5’s

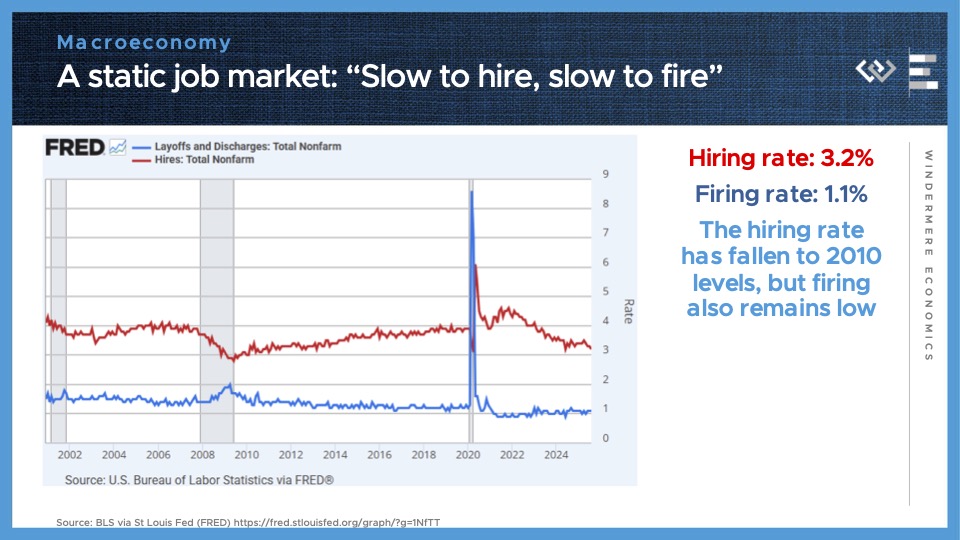

* Goldilocks labor market – your job is secure, low firing rate.

But still tough for entering job market.

* Homeowners have more equity than ever to sell & reinvest

* NASDAQ up 20% EOY 2025 despite drop in April

* 2025 tax cuts favor higher income families, aka, homebuyers

* Seattle is back to being top population growth market,

especially people moving here from international

* Seattle median price projected to be from flat to +7%,

depending on area.

And, our weekly update from our mortgage guru, Adam, at our Wedgwood Windermere office:

Good afternoon Windermere Wedgwood,

Quick update:

Late Thursday the President instructed Fannie Mae and Freddie Mac to buy $200B of mortgage‑backed securities. Markets reacted immediately, and mortgage rates moved lower even after trading hours. If the GSEs (Government Sponsored Enterprises {Fannie Mae, Freddie Mac}) follow through (roughly $20B/month implied), mortgage spreads should tighten and rates could decline further, though expect some volatility in the coming weeks as details and timing are clarified.

This morning’s BLS jobs report was a touch softer than expected: 50,000 jobs added (vs. 60,000 expected) and the unemployment rate eased slightly from 4.6% to 4.5% (4.56% → 4.48% before rounding). Combined with the GSE news, rates have moved down today.

Today’s rate snapshot:

30‑yr fixed: 5.75%

30‑yr jumbo: 5.99%

5/6 jumbo ARM: 5.50%

FHA/VA: 5.25%

Adam Zylstra

Branch Manager

NMLS #507001

(425) 879-0766

Adam.Zylstra@GenHL.com

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link