There is a misconception amongst consumers that mortgage rates automatically push higher when the Fed raises its benchmark Fed Funds Rate. Let’s remember that the Fed can’t control long-term rates, which are more based on economic conditions and inflation expectations.

Consumers will be impacted in the following ways:

Basically, short term interest rate loans are affected. Credit card rates will be adjusted a bit higher along with HELOC rates, auto and business loans. Theoretically, Banks should provide a bump in savings accounts for consumers as Banks will now receive a bump in their overnight lending rates…but don’t hold your breath there just yet. Big Banks may not see pressure to increase savings interest rates in the near-term – so Banks will keep this spread for a bit.

As mentioned, if the economy continues to improves, wages move higher and inflation expectations tick up – mortgage rates will move higher as well. Be sure to also share with clients that the Fed also said yesterdays they will continue to buy MBS with the runoff from their huge $4T portfolio. Later today, the New York Fed will be purchasing up to $2B in Fannie/Freddie 30-Year 3% and 3.5% coupons.

Here is an example about rate impacts: Yesterday the rate for conventional fixed 30 year was 4.125% and .25 points. Today for 4.125% is .125 points. That’s right, actually got a bit better.

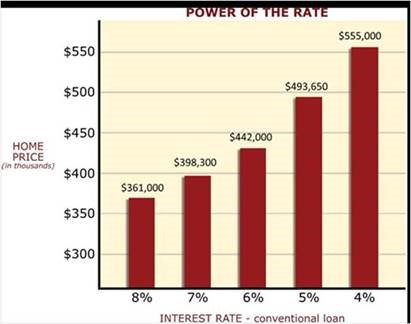

Please advise your clients that rates can truly impact borrowing power.

Here is a tool that you can use that I often use.

Warm [Energy Efficient] Regards,

Dave Porter

LEED GA, CGP, CAPS, MIRM, SRES, NAR Green

MLO# 483876

Cell: 206-304-8228

eFax: 425-324-3362

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link