I was able to listen to our chief economist for Windermere yesterday for his annual economic forecasts heading into 2020. The slides below illustrate his forecast for the Seattle area moving into 2020. #realestateislocal

Matthew Gardner, while being one of the brightest minds in our company, knows how to deliver a message.

We all know that most economist are calling for a national recession in the not too distant future. But most are now pushing back for this to begin in mid 2021, be short lived and not focused on the housing market like the great recession.

Matthew feels the next recession will be due to the ongoing trade wars with China and the EU as well as our escalating national debt. With interest rates already at historic lows, the Fed will NOT be able to help end the recession by lowering rates.

But the Seattle area will be somewhat insulated to these national issues in the coming years, here’s why…

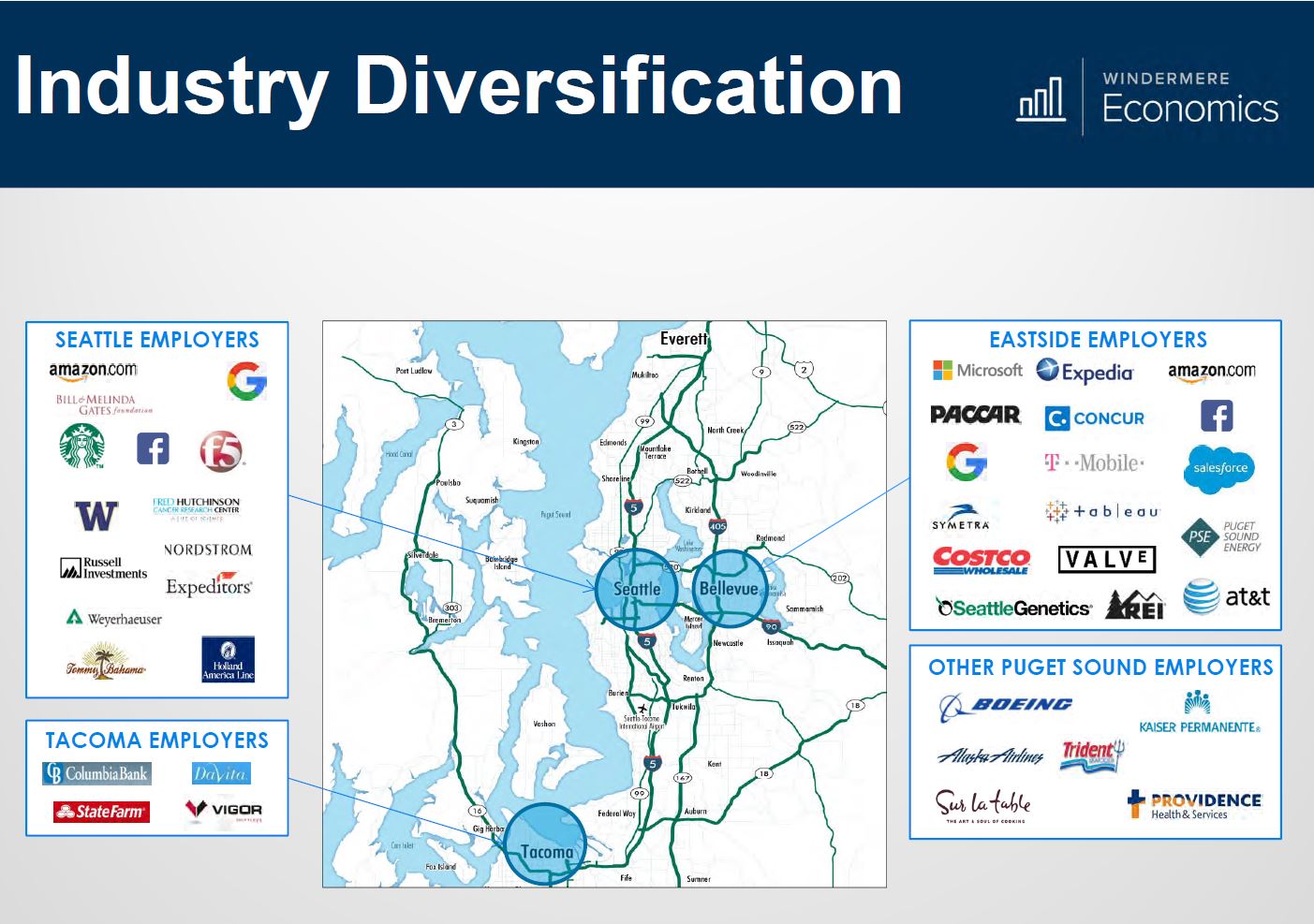

- We’re no longer a one trick pony. Like when this sign from 1973 went up during a Boeing slump. Seattle’s industries have diversified. There are now 34 Fortune 500 companies in the Seattle Area compared to 7 just a few years ago! Boeing is still king with over 80,000 employees in the area but their ups and downs don’t threaten the Seattle economy like they did not too long ago.

- The tech industry is the largest employer in the Seattle Metro area and have driven our unemployment #’s down to 3%.

- The other employers to round out the top 5 for the Seattle area are JBLM, Joint Base Lewis McCord (56,000), Microsoft (42,000), Amazon (25,000) and UW, University of WA (25,000). A healthy mix of different industries that are projected to grow their employment by 2.2% next year, again leading the nation.

- All of these growing companies in the Seattle area are why our economy will continue to expand through 2020.

- There is still no signs of a Housing Bubble.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link