What exodus? Seattle kept growing during pandemic

From my little Seattle centric real estate world, it felt like a busy year. I heard all the stories of people fleeing cities across the US but when you look at the data, Seattle’s population grew +1.1% over the last year. As this article in the Seattle Times says, “not a record-breaking year, to be sure, but still respectable.” Seattle bucks the trend of just about every other top 20 metro in the country with this population growth.

This matters to all of us in the region because it shows the continued interest and desirability of the Seattle area for investment and job seekers.

The future is still bright for Seattle metro and our state and this is just one indication of that strong economic future.

Let the predictions begin…

Windermere’s Chief Economist Matthew Gardner dusts off his crystal ball and peers into the future to give us his predictions for the 2021 economy and housing market.

U.S. ECONOMY

Gardner predicts a rise in housing inventory, as people who can work remotely move farther away from their offices, or those whose homes aren’t conducive to remote work seek out a better living arrangement.

But Gardner also pragmatically points out that a “mass exodus” completely away from urban centers is unlikely, as many workers may find themselves with a flexible blended arrangement of remote work and a few days in the office per week.

HOME SALES

Gardner is predicting a large increase in home sales in 2021 (he covers new construction separately). His forecast puts home sales up by 6.9%, a level that hasn’t been seen since 2006.

NEW CONSTRUCTION

With the rising demand for housing inventory, Gardner predicts that new construction starts for single-family homes will rise by a sizeable 16.4%. This is great news for builders, and also for buyers, as increased inventory may help to alleviate the incredible demand the market has been experiencing.

MORTGAGE RATES

Along with increased starts, Gardner is anticipating an increase of 18.7% in new home sales for 2021—again reaching a level the market hasn’t seen since 2006.

Throughout 2020, mortgage rates hit historic lows, largely due to the impact COVID-19 had on the housing market. These low rates drove already high demand for housing even higher, and Gardner does not predict mortgage rates will rise significantly in 2021.

His current forecast sees mortgage rates dropping to their lowest rate in the current quarter at 2.83%, and rising to about 3.08% by the fourth quarter of 2021.

CONCLUSIONS

Though Covid has certainly impacted the housing market in ways we never could have anticipated, there is plenty of reason to believe the market will continue to recover in 2021. New home construction and sales provide a particularly optimistic outlook, while low mortgage rates could give first-time buyers a chance to break into the market.

Click the link below for Matthew’s weekly economic and housing update on the Windermere blog.

Pending Sales up +15% vs LY!

I’m still amazed at the residential housing market’s resiliency through all that his happening in our economy.

Cliff notes below from our designated broker, Laura Smith –

Expect more new listings. Expect more new pending sales. Historically March to July are the five months with the most new listings (10 year average for King County Residential shown in table below). The coronavirus likely delayed new listings by 45 to 60 days. What will happen with more new listings? More new sales. My guess is starting in July number of sales in 2020 will exceed the number of sales in 2019.

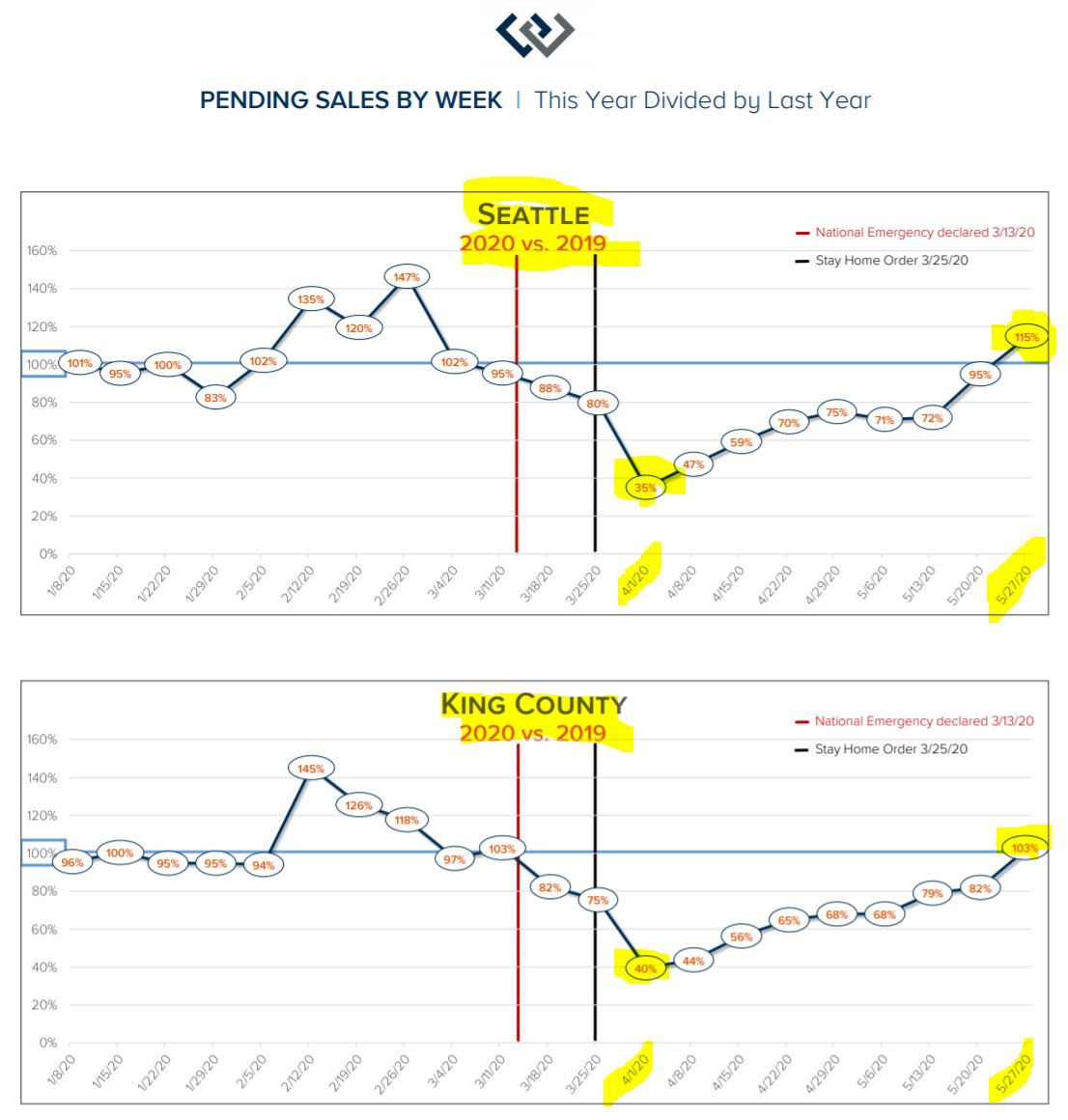

King County Residential Only for the weeks ended Wednesday (5/27/20):

Summary (details below):

The number of new pending sales in the last seven days exceeded the same week in prior year.

- Expect next week for sales to be between 80% and 100% of the prior year.

- Memorial Day under the stay order had less impact on sales than Memorial Day with no stay order.

Number of King county pending sales increased for the last nine weeks:266, 309, 367, 460, 489, 508, 598, 622, and 645.

We need inventory! Inventory is down over 40% and sales are equal to a year ago.

Months Supply of Inventory is low enough to make multiple offers commonplace:

- King County is 0.9 > down 40% from a year ago (1.6).

- Seattle is 0.9 > down 53% from a year ago (1.9).

- Eastside is 1.0 > down 50% from a year ago (2.0).

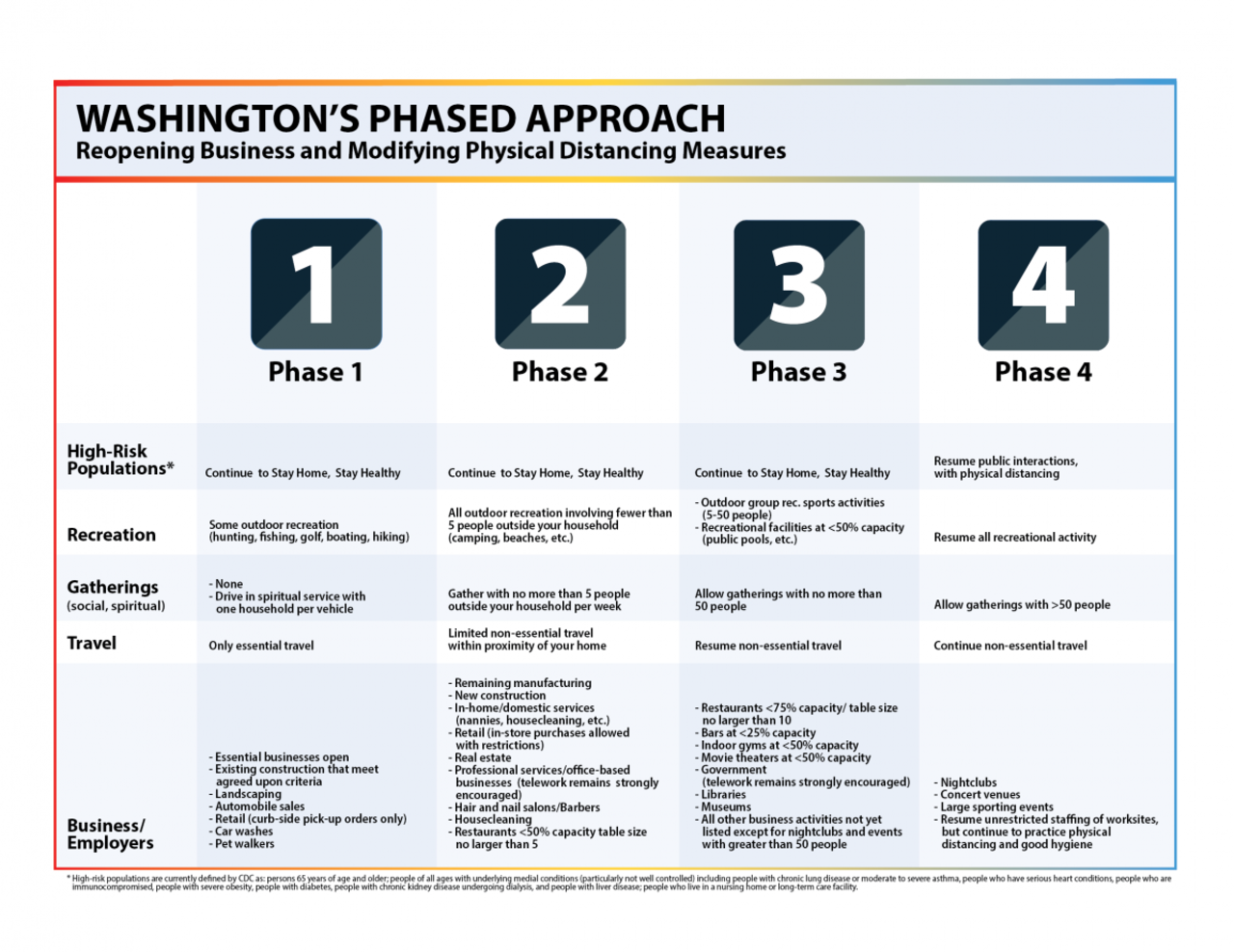

Phased RE Opening & Rebound

Gov. Inslee lays out our plan

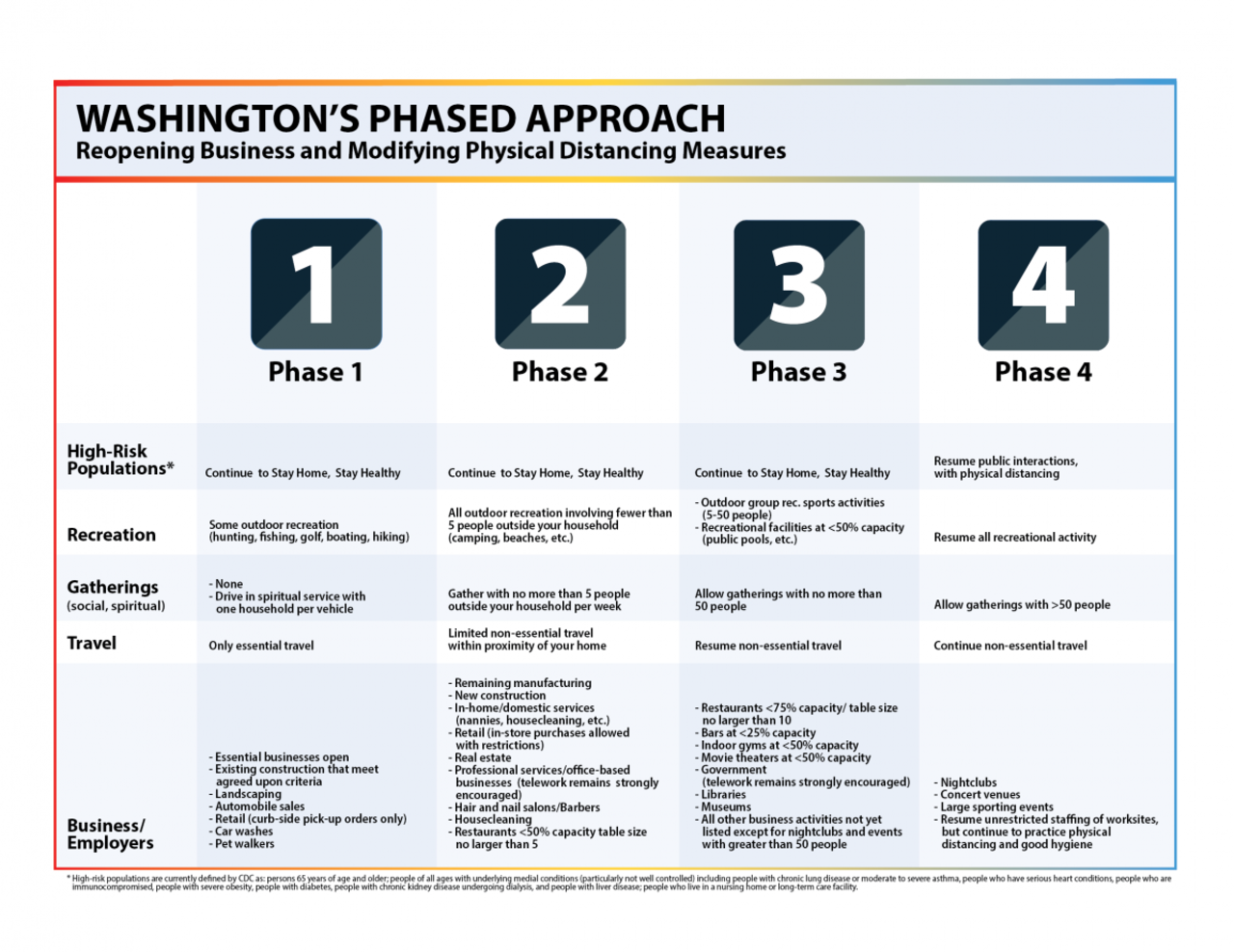

A 4 Phase plan to re-open Washington from the Stay Home Order.

In this letter, I will give my interpretation of this plan and how it relates to real estate along with updates and clarifications from the WA Realtor Association.

This plan is similar to many other states including NY and CA in that it has specifics about what can open at each Phase but doesn’t put a timeline on future phases.

But, Phase 1 started on Monday the 5th! Each phase should last about 3 weeks.

The WA Realtor Assc. announcement, below, interprets the governors announcement for real estate activity.

It says that all real estate activities will be allowed in Phase 2, with the exception of maybe in person open houses since gatherings are restricted to 5 people total.

Also in Phase 2, housecleaning is allowed which I think gives way to allowing contractors into your house to prep your home for sale.

GOVERNOR ANNOUNCES 4 PHASE APPROACH – from WA Realtors Assc.

On Friday, May 1st Governor Inslee announced an extension of the “Stay Home, Stay Healthy” order to May 31st and laid out a phased approach to re-opening the State economy. Phase 1 begins Tuesday, May 5th. Please note that this does not affect the modifications that were made to the original Stay Home, Stay Healthy order that allow certain real estate activities to take place.

Phase 2 businesses will include all other real estate activity including commercial real estate, the re-opening of real estate offices, and services such as sign installation. Phase 2 also allows gatherings outside your residence for up to 5 people, which presumably would apply to parts of the real estate transaction such as showings, appraisals notarizations, etc. The Governor’s phased-in plan will apply in counties that have been harder hit by COVID-19. The 10 counties that have not been as impacted by the virus will be allowed to apply for waivers that will let them open up faster (see KING5 story for summary).

Although it is not yet clear when Phase 2 will begin, we will be in constant dialog to make our case for the earliest possible start date that is consistent with maintaining public health as the number one priority, and we also will continue urging the Governor’s office to approve additional, and safe, modifications that we’ve requested to allow brokers to more fully meet the needs of their clients.

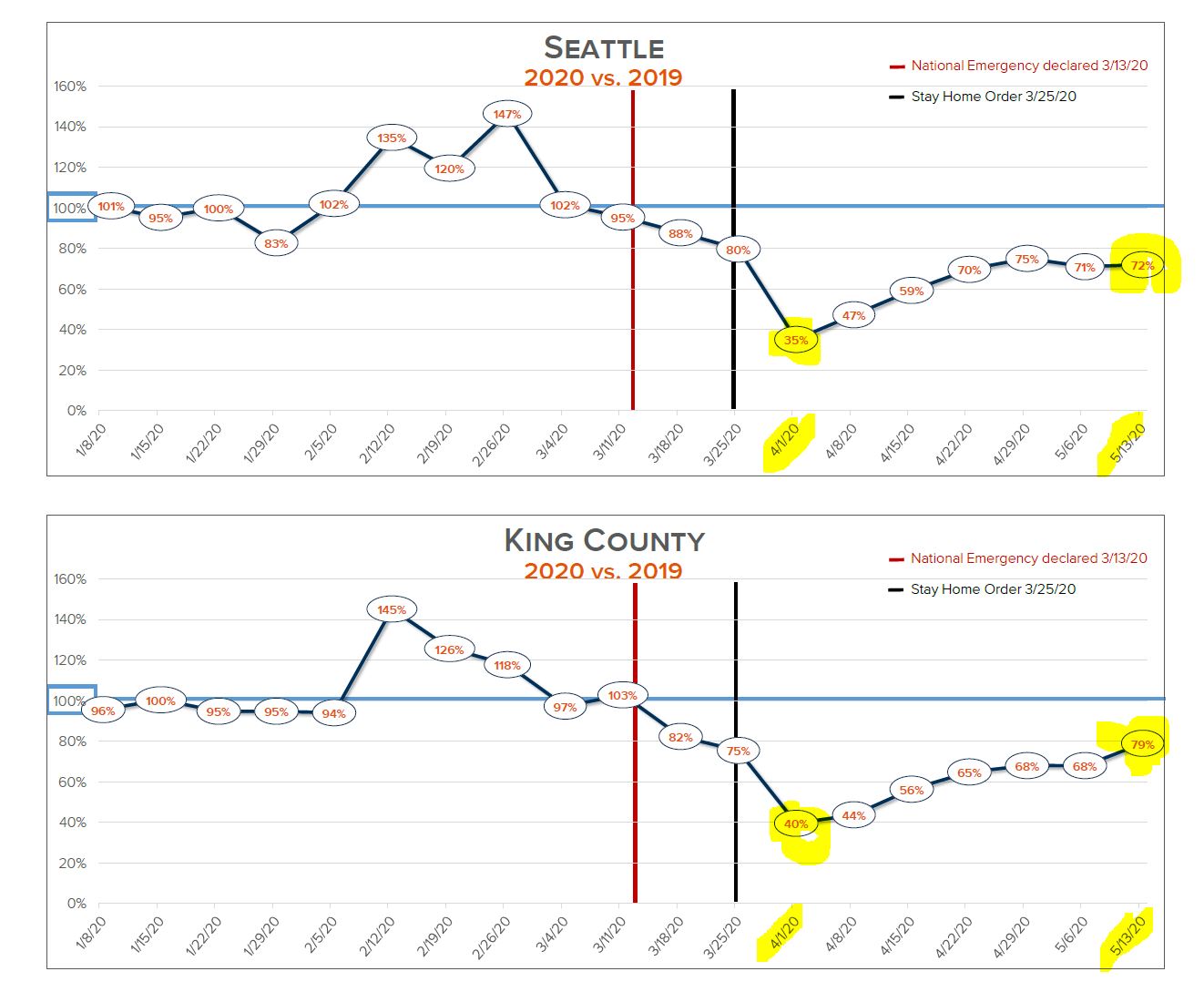

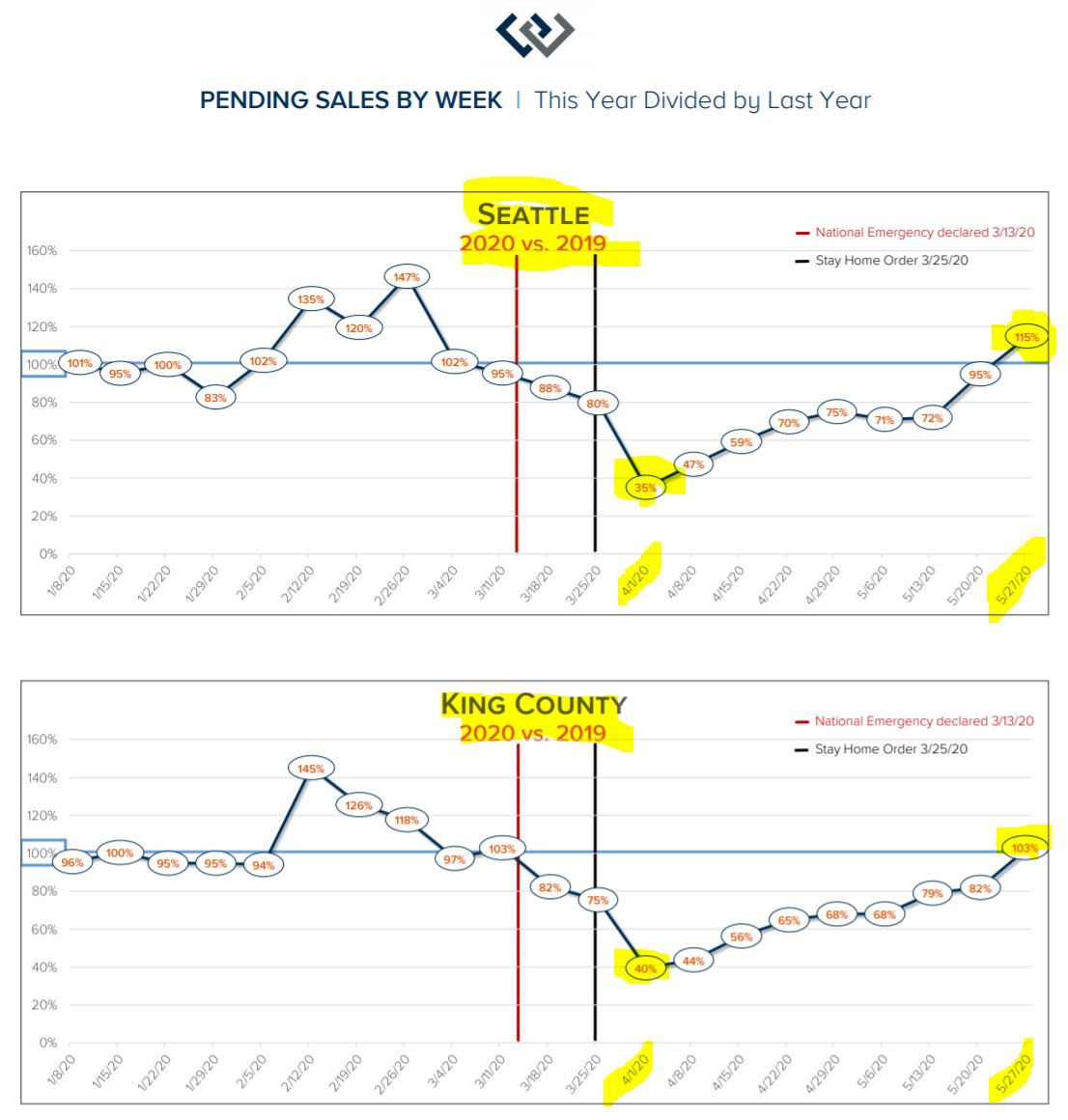

RE Transactions Rebound

Transactions in Seattle and King Co. bottomed out the first week of April, down -65% vs LY but have been increasing since this low.

This data plus a decrease in market time to sell a home and a +8% increase in sold home prices in April in Seattle show us that there are still buyers in the market and they are transacting.

The residential real estate market is still active and I think it will be headed back to “normal” once we are further along into Phases 2 & 3 this summer.

Only time will tell how the Stay Home Order will ultimately impact our housing market.

So far, real estate is fairing better than most segments of our economy.

Almost $700k for our neighbors in need!!

Thank you, thank you to all that helped support this incredibly worthy cause to help our neighbors in need and bring food and resources to our local food banks.

Our agent supported Windermere Foundation matched $250,000 to the $440,000 raised to get the total donation to almost $700,000! Amazing!

Life goes on…

I know it’s been hard for all of us to adapt to this crazy time and it is so much

more challenging for the most vulnerable in our city.

Things around my house have been moving forward, sometimes without me. I owe so much to my incredible family!

They have all stepped up and kept a positive attitude while spreading some kindness.

With love, the Johnson’s

My wife, Lari, and I celebrated our lucky

13th wedding anniversary in early May!

2020 – Why you want to be in Seattle

I was able to listen to our chief economist for Windermere yesterday for his annual economic forecasts heading into 2020. The slides below illustrate his forecast for the Seattle area moving into 2020. #realestateislocal

Matthew Gardner, while being one of the brightest minds in our company, knows how to deliver a message.

We all know that most economist are calling for a national recession in the not too distant future. But most are now pushing back for this to begin in mid 2021, be short lived and not focused on the housing market like the great recession.

Matthew feels the next recession will be due to the ongoing trade wars with China and the EU as well as our escalating national debt. With interest rates already at historic lows, the Fed will NOT be able to help end the recession by lowering rates.

But the Seattle area will be somewhat insulated to these national issues in the coming years, here’s why…

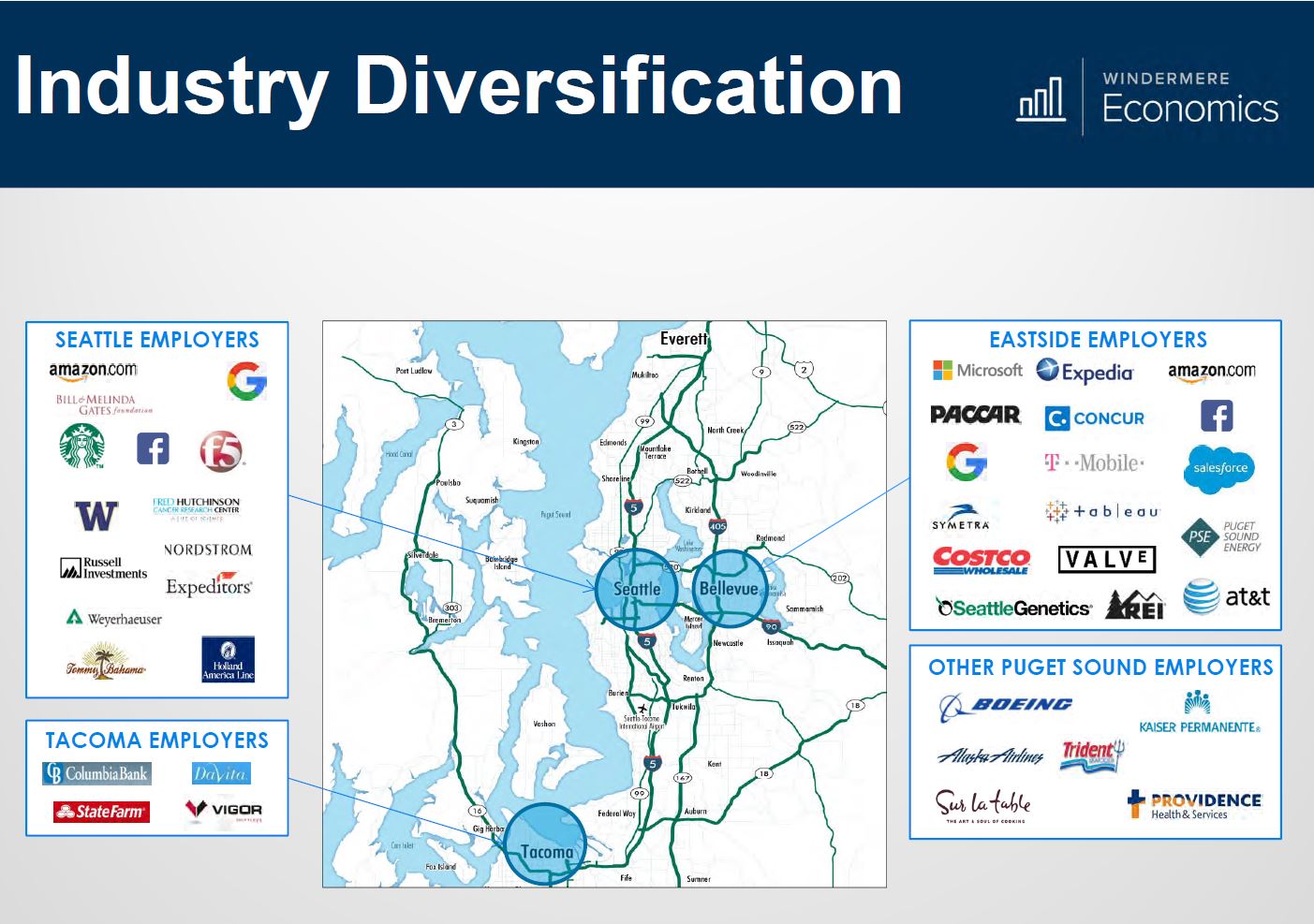

- We’re no longer a one trick pony. Like when this sign from 1973 went up during a Boeing slump. Seattle’s industries have diversified. There are now 34 Fortune 500 companies in the Seattle Area compared to 7 just a few years ago! Boeing is still king with over 80,000 employees in the area but their ups and downs don’t threaten the Seattle economy like they did not too long ago.

- The tech industry is the largest employer in the Seattle Metro area and have driven our unemployment #’s down to 3%.

- The other employers to round out the top 5 for the Seattle area are JBLM, Joint Base Lewis McCord (56,000), Microsoft (42,000), Amazon (25,000) and UW, University of WA (25,000). A healthy mix of different industries that are projected to grow their employment by 2.2% next year, again leading the nation.

- All of these growing companies in the Seattle area are why our economy will continue to expand through 2020.

- There is still no signs of a Housing Bubble.

Gardner Report 2019 – Q3

Our esteemed economist, Matthew Gardner, has released his 3rd quarter assessment of our Western WA real estate market. Enjoy!

Market Update – W-WA down to Seattle

The Gardner Report will tell you what’s happening in WWA real estate and a forecast for 2019.

The other graphs show you how the Seattle real estate market is trending for Q1 of 2019.

Some of the hotter neighborhoods are seeing over +15% price appreciation Feb to Mar 2019.

But most economist don’t feel we’re returning to the craziness of the last few years.

A much more manageable growth rate moving forward for Seattle, that’s nice for everyone, buyers and sellers.

WW Stats – Up +10.5% – Median Price!

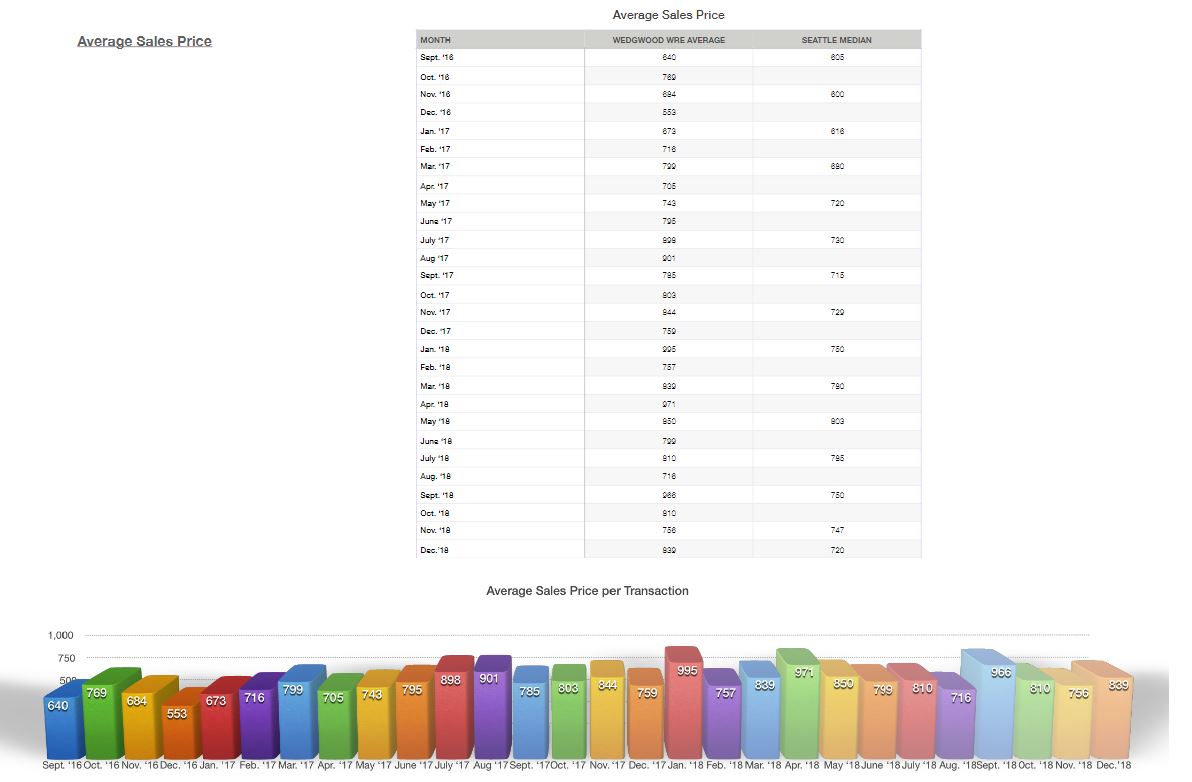

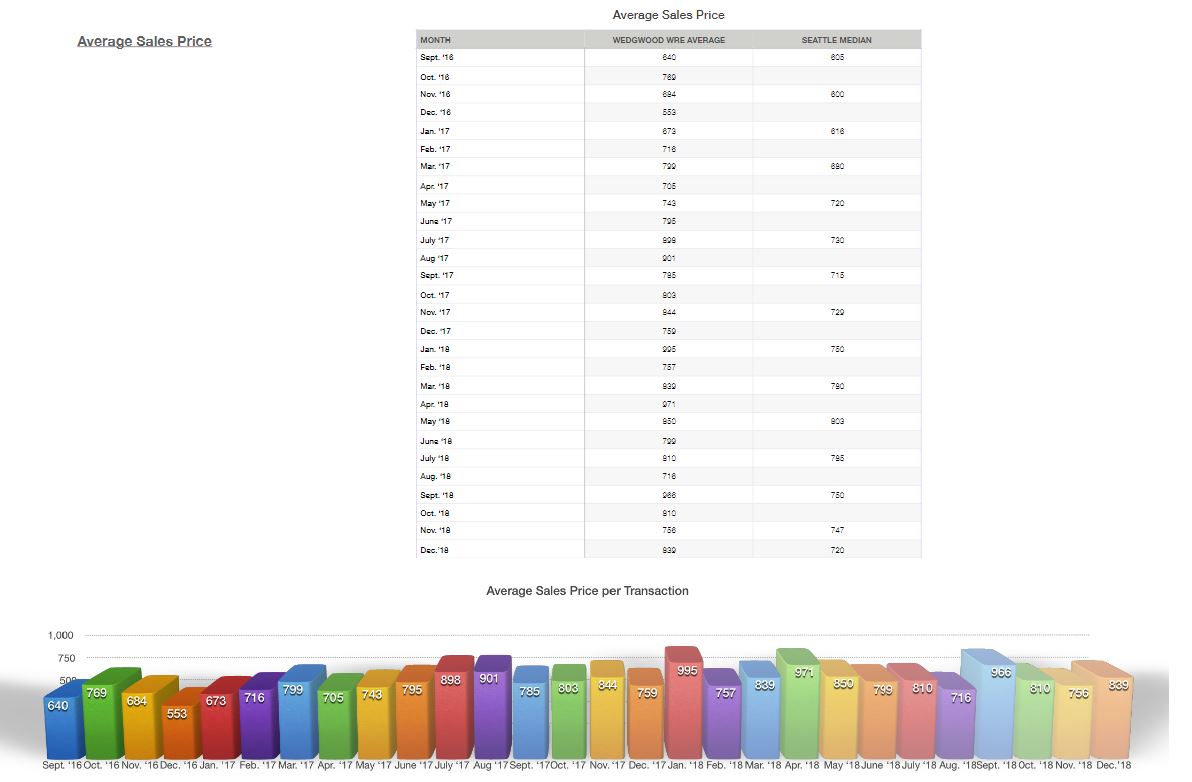

My office, Windermere Wedgwood, publishes statistics for the transactions that we represent each month.

These statistics dive deeper than the basic info you get from online sources.

The pack below shows transaction details like type of financing, cash offers, # of offers and the one I find most interesting this month, median sold price.

The median sold price for the 16 transactions completed by my office in December 2018 was $839k vs. $759k from Dec. 2017 or +10.5%

Even with the Seattle Times headlines about Seattle’s rapid decrease in prices, the numbers don’t lie, +10% vs last year!

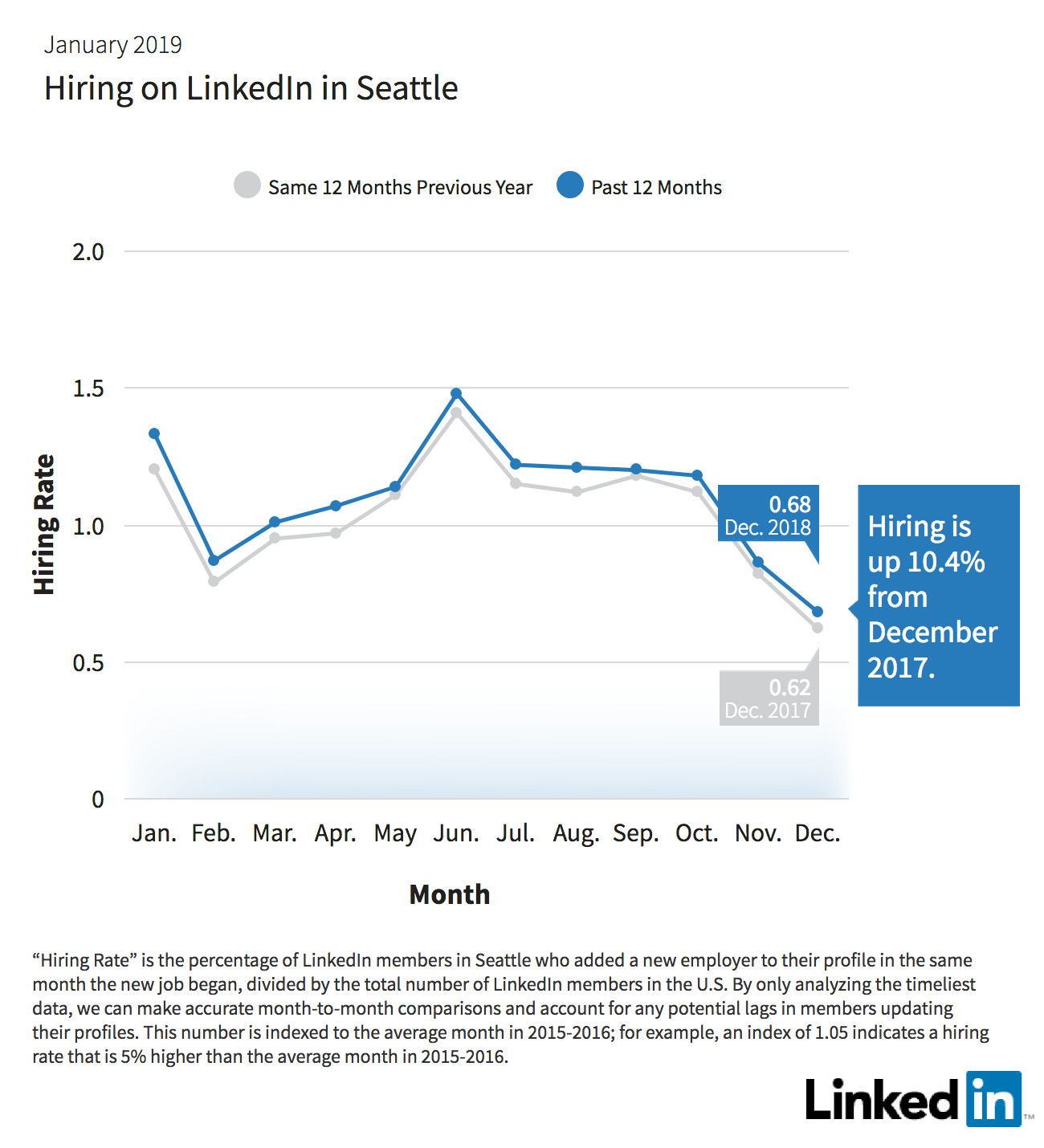

Hiring in Seattle up +10% vs 2017!

So much for the HQ2/3 impact on the Seattle employment picture.

This workforce report is pulled from LinkedIn data but a good indicator of what’s happening in the broader market.

While Amazon might be slowing down their rate of hiring in Seattle, others are ramping up for 2019 and beyond – Expedia, Facebook and Google to name a few.

Seattle is still a great place to invest your real estate dollar and looks to continue…

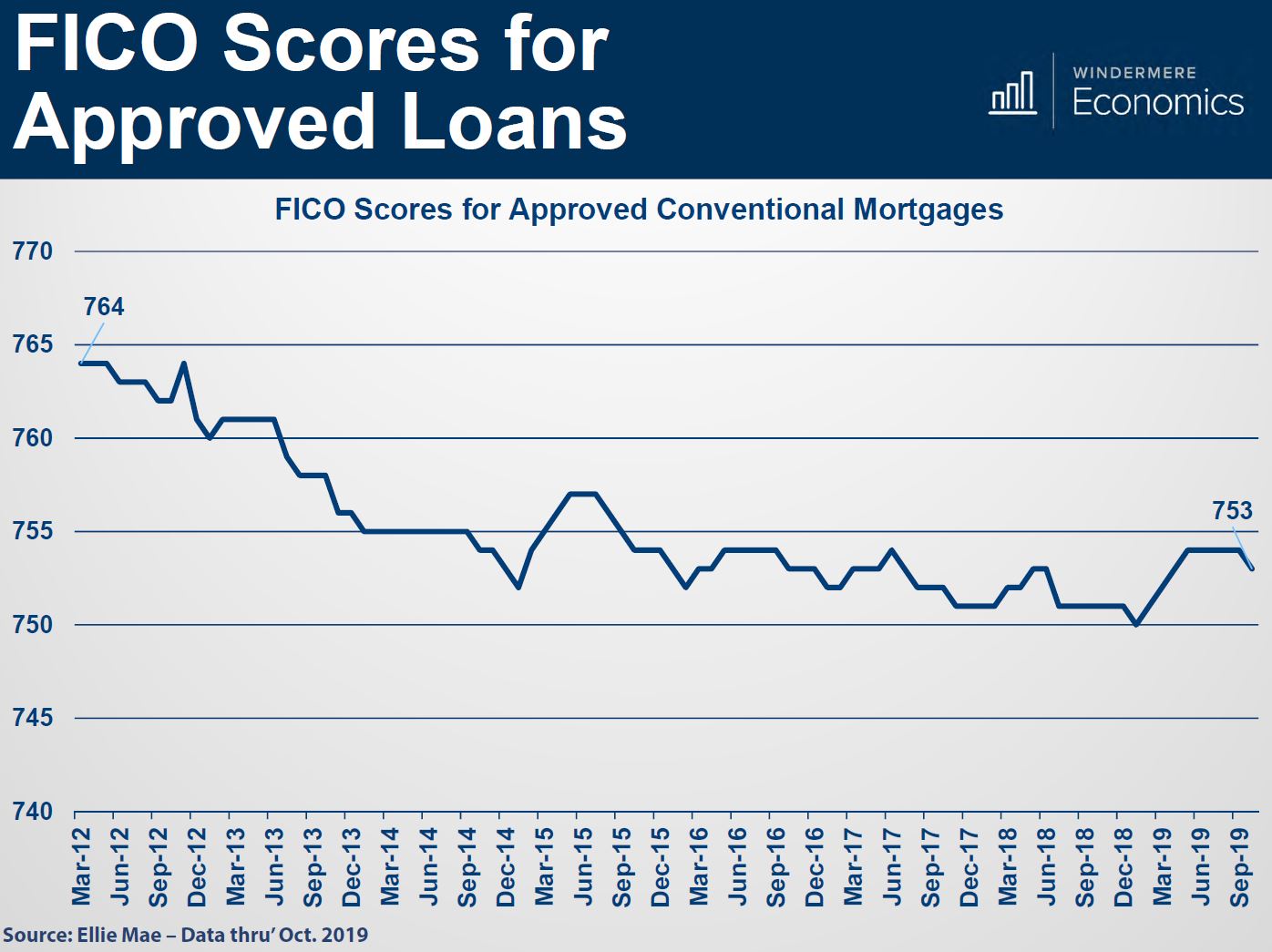

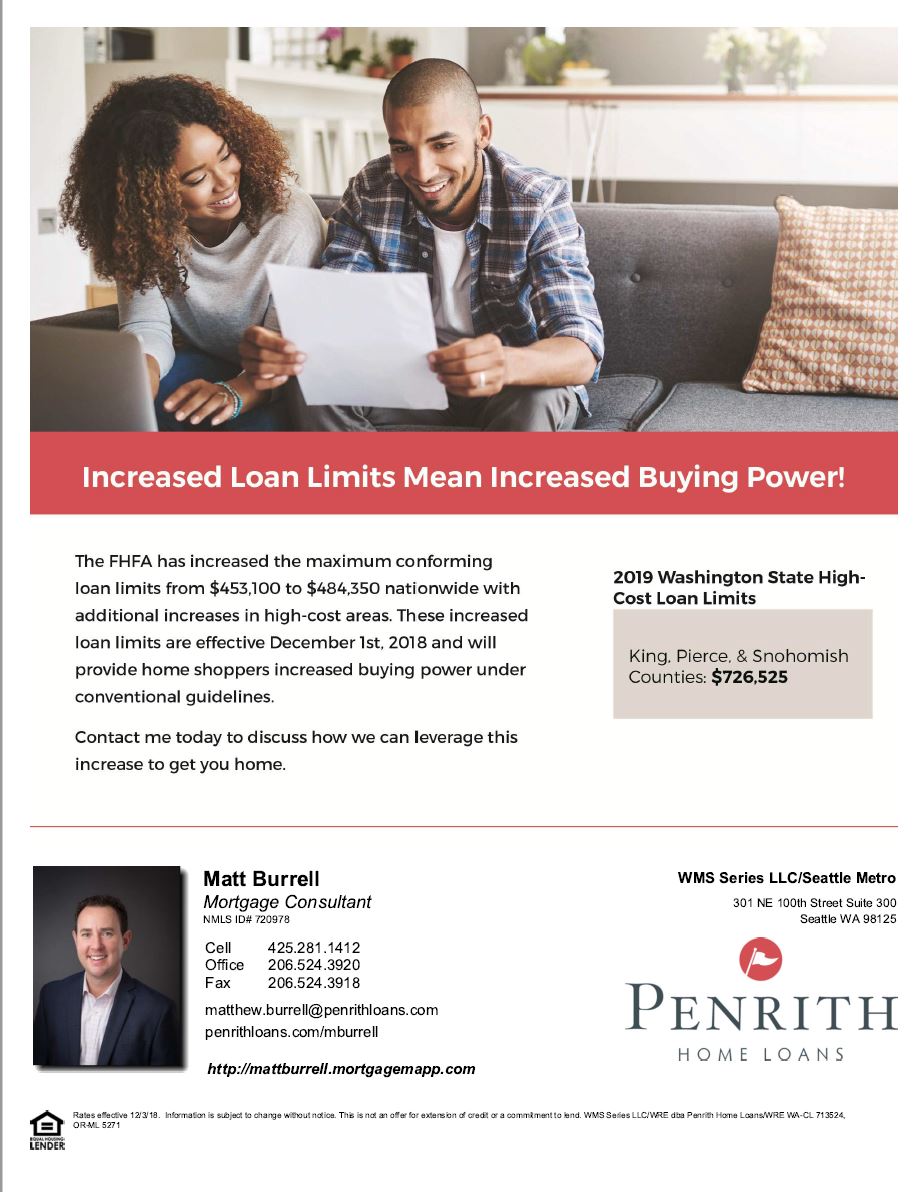

Increased Loan Limits mean Increased Buying Power

Has your lender told you about the upcoming changes for conforming loans in 2019?

Make sure you’re working with a knowledgeable lender that keeps you informed on the latest and the greatest.

Thank you Matt for always keeping me up to date.

New conforming loan limits for King/Pierce/Snohomish county – all the way up to $726,525.

Gives you more purchasing power and reach.

A $725,000 home purchase will now qualify for a conforming loan with as little as 5% down payment of $36,250.

You’ll be able to afford more home and still be competitive in the changing Seattle area market!

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link